We are updating our website

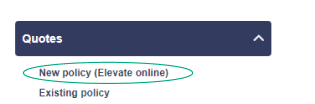

So that we can direct you to the right page,

please select your product from the list below.

Nippon Life Acquisition | Resolution Life Australasia part of the Acenda Group

Nippon Life Insurance Company acquired the Resolution Life Group globally, including Resolution Life Australasia, on 30 October 2025, and have established the Acenda Group in Australia and New Zealand. Read more about the Acenda Group here.

Any references to Resolution Life Group on or available through this website are historical.

|

|

|

|

|

|

|

|

|

|

|

|

|

If you do not have a quote, complete the Online quotes enquiry form.

|

|

|

1. Log into portal.  5. Follow the steps within the Premium calculation tool to obtain this quote.

Obtain an increase quote for other products: 1. Complete the Online quotes enquiry form |

|

|

|

|

|

1. Log into portal.  5. Follow the steps within the Premium calculation tool to obtain this quote.

Obtain a decrease quote for other products: 1. Complete the Online quotes enquiry form |

|

|

1. Log into portal.  5. Follow the steps within the Premium calculation tool to obtain this quote.

Obtain a decrease quote for other products: 1. Complete the Online quotes enquiry form

|

|

|

|

|

|

1. Log into portal.  5. Follow the steps within the Premium calculation tool to obtain this quote.

Obtain a decrease quote for other products: 1. Complete the Online quotes enquiry form

|

|

|

1. Log into portal.

|

|

|

|

|

|

|

|

or premierlink options, TPD or Trauma options |

|

|

Reinstatement process and requirements for Elevate products only

|

|

|

|

|

|

|

|

|

|

| For policies written on or before 31 December 2017 (ie grandfathered from LIF arrangements): Premium arrears must be paid in full. For policies which started from 1 January 2018 (ie post-LIF policies): A premium payment calculated as at date of reinstatement. |

|

|

|

(i) To reinstate Childrens’ trauma, please complete the Children’s Trauma Personal statement.

Note: The policy may be eligible to be reinstated without application and underwriting requirements. Contact Resolution Life to confirm eligibility.

Where the information on this website is factual information only, it does not contain any financial product advice or make any recommendations about a financial product or service being right for you. Any advice is provided by Resolution Life Australasia Limited ABN 84 079 300 379, AFSL No. 233671 (Resolution Life), is general advice and does not take into account your objectives, financial situation or needs. Before acting on this advice, you should consider the appropriateness of the advice having regard to your objectives, financial situation and needs, as well as the product disclosure statement and policy document for the product. Any guarantee offered in the product is only provided by Resolution Life. Any Target Market Determinations for our products can be found at resolutionlife.com.au/target-market-determinations.

Resolution Life does not make any representation or warranty as to the accuracy, reliability or completeness of material on this website nor accepts any liability or responsibility for any acts or decisions based on such information.

Resolution Life can be contacted at resolutionlife.com.au/contact-us or by calling 133 731.