We are updating our website

So that we can direct you to the right page,

please select your product from the list below.

Nippon Life Acquisition | Resolution Life Australasia part of the Acenda Group

Nippon Life Insurance Company acquired the Resolution Life Group globally, including Resolution Life Australasia, on 30 October 2025, and have established the Acenda Group in Australia and New Zealand. Read more about the Acenda Group here.

Any references to Resolution Life Group on or available through this website are historical.

If remuneration deposits are from Resolution Life, the following information is displayed on licensee bank accounts:

Company name – Resolution Life

Payee ID – 6-digit code and NNNNN-N codes

For example:

Date | Company name Payee ID | Amount

|

2/09/2024 | Resolution Life 242271 | $4,443.31 |

2/09/2024 | Resolution Life NDNGS-E | $1,268.01 |

If the statement does not have the requirements as described above, the deposit was made by another party.

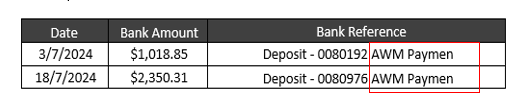

For example:

In these cases, please contact your bank or financial institution to confirm which company made these deposits.

Resolution Life does not currently publish commission statements for financial advisers. We publish this for licensees only. Therefore, advisers must contact their licensee to obtain commission statements

You may request a commission report from the adviser remuneration team by sending a request email to Adviserremuneration@resolutionlife.com.au

You will need to supply the Adviser’s name and their code.

Please refer to the commission calendars above.

No, this cannot be done, including due to product and system constraints.

For information about current commission rates, please contact the adviser remuneration team for further information.

Unfortunately, this cannot be viewed on the portal currently. Please contact the adviser remuneration team for further information.

If you are sending the request on behalf of the adviser, please provide the Adviser’s name, and their code as well as the client’s name and policy number.

Generally, where cover was transferred from another policy, new business commissions are generated at the commencement of the new policy using the same rate as the renewal commission rate. Please note, the responsibility period applies to new business commissions.

For further information about commission rules on responsibility period and transfer rules, please contact the adviser remuneration team.

New business commission is payable on increases by endorsement, which include:

• increases of contracted premium on the existing base plan and additional benefits; and

• increases in contracted premium arising from the addition of a benefit not previously attached to the plan

Any increase by endorsement will be paid new business commission at the commission rate that applied when the original policy commenced.

Where the information on this website is factual information only, it does not contain any financial product advice or make any recommendations about a financial product or service being right for you. Any advice is provided by Resolution Life Australasia Limited ABN 84 079 300 379, AFSL No. 233671 (Resolution Life), is general advice and does not take into account your objectives, financial situation or needs. Before acting on this advice, you should consider the appropriateness of the advice having regard to your objectives, financial situation and needs, as well as the product disclosure statement and policy document for the product. Any guarantee offered in the product is only provided by Resolution Life. Any Target Market Determinations for our products can be found at resolutionlife.com.au/target-market-determinations.

Resolution Life does not make any representation or warranty as to the accuracy, reliability or completeness of material on this website nor accepts any liability or responsibility for any acts or decisions based on such information.

Resolution Life can be contacted at resolutionlife.com.au/contact-us or by calling 133 731.